For some time there have been questions surrounding how servicers can protect the lien rights of their investors with regard to the lien position of Homeowner Association properties, but there are ways to avoid this conflict.

For some time there have been questions surrounding how servicers can protect the lien rights of their investors with regard to the lien position of Homeowner Association properties, but there are ways to avoid this conflict.

The problem stems from the various lienholders of a property residing in one of these communities, according to a whitepaper released by LRES on Wednesday.

When an HOA forecloses on a property for unpaid association fees, the servicer faces significant risk of increased loss and even of losing its investor’s stake in the property, the report said. "Since no investor would consider this acceptable, servicers are left in need of a better method of managing the HOA lien process," LRES stated.

“Homeowner associations are very important to the housing industry as a whole, which is why it is extremely important for servicers to have a good understanding of the risks to be mitigated and the requirements for doing so," said Roger Beane, LRES founder and CEO.

Source: LRES

The report found that there are 350,000 HOAs in the U.S. Together, these organizations claim more than 25 million households as members, which means one out of every five households in the country is subject to HOA rules and fees.

"That makes these organizations significant partners in the housing economy and makes it very dangerous for any servicers to ignore the fees and fines they levy or the liens they place on the homes that serve as collateral for mortgage assets," LRES said in the report.

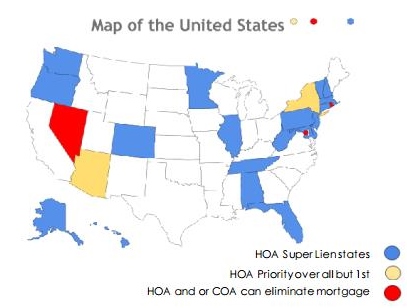

According to LRES, there are 22 states across the country where these associations can file a lien that becomes superior to that held by an investor who holds the rights to a first deed of trust: Alabama, Alaska, Colorado, Connecticut, Delaware, Florida, District of Columbia, Hawaii, Illinois, Maryland, Massachusetts, Minnesota, Nevada, New Hampshire, New Jersey, Oregon, Pennsylvania, Rhode Island, Tennessee, Vermont, Washington, and West Virginia.

LRES offered the following solutions for an effective HOA lien strategy:

- Servicers should understand the risks to be mitigated and the requirements for doing so. The actual risk any individual servicer faces is dependent upon the portfolio it services. Once the risk exposure is known, the servicer can undertake any remedial action required to clear existing HOA liens.

- When the loan enters default, constant monitoring of loans that may be impacted by unpaid HOA fees must be actively monitored. This work must continue after foreclosure and until the REO is sold back into the market. In this way, the servicer can protect the investor’s interest.

- Avoid HOA foreclosures by quickly remediating HOA liens. A good third-party real estate information provider with the capacity to identify problems, gather the information and negotiate solutions is a critical element to any servicer strategy for mitigating this risk.

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news