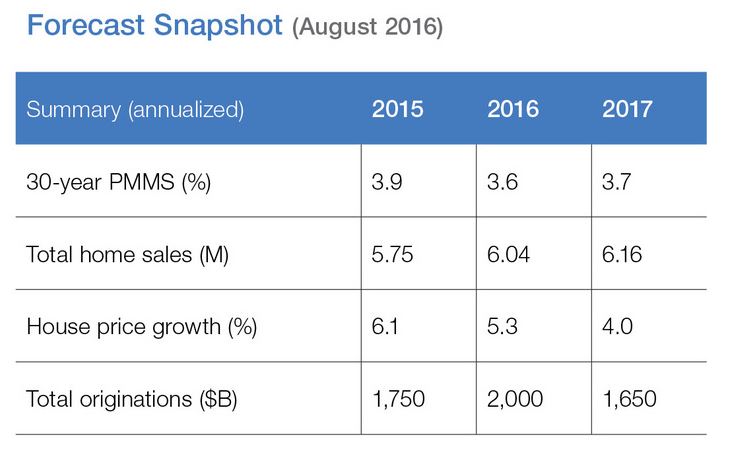

After four years and a lot of rollercoaster rides, the mortgage originations market is zeroing in on the $2 trillion mark, according to Freddie Mac’s August 2016 Outlook report. Freddie Mac credited the balance between low interest rates and solid home sales as signs of an improving originations sector.

After four years and a lot of rollercoaster rides, the mortgage originations market is zeroing in on the $2 trillion mark, according to Freddie Mac’s August 2016 Outlook report. Freddie Mac credited the balance between low interest rates and solid home sales as signs of an improving originations sector.

“At the current pace, we're likely to see the mortgage market top $2 trillion in originations for the first time since 2012,” said Sean Becketti, chief economist, Freddie Mac.

Unlike in 2012, however, when the market was driven largely by refinances, today's market is nearly 50/50 balanced between home refinances and purchases. “This is good news for home sales as we're likely to see the best year in home sales in a decade,” Becketti said. “This is a good sign for the housing market as it continues to be an even brighter spot in the economy.”

Mortgage rates, expected to stay below 4 percent into 2017, and more optimistic expectations for home sales (to 6.04 million, the highest number this decade) are Freddie Mac’s main leg on which to stand with its enthusiasm. The GSE expects strong home sales to boost 2016 forecasted mortgage originations by $175 billion over July’s forecast, and for housing construction to remain on an upward trend‒‒1.2 million and 1.4 million for 2016 and 2017, respectively.

Source: Freddie Mac

Through the first six months of 2016, home sales totaled 2.9 million, non-seasonally adjusted, according to the report. This is the fastest pace since the first half of 2007.

“We are forecasting that home sales will outpace 2007 in the second half of this year, reaching the highest level since 2006,” the report stated.

With the job market consistently improving, wage growth ticking higher, and mortgage interest rates remaining low, Freddie Mac expects home sales to rise throughout the rest of this year. But there is, of course, caution to the GSE’s predictions.

“The housing market still has challenges, which is reflected in our housing starts forecast,” Becketti said. “Low levels of inventory across many markets will continue to put upward pressure on house prices for the foreseeable future."

“We expect GDP growth to bounce back to just over 2 percent for the remainder of 2016 as inventory investment rebounds and the drag by energy begins to ease and push nonresidential investment up,” the report stated. “However, recent global uncertainty and its effects on domestic production have led us to reduce our forecast for GDP growth in 2017 by 30 basis points to 1.9 percent.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news