With the economy sending mixed signals, average mortgage interest rates—which have been hovering right above historic lows for weeks—may be a little confused on which way to go.

With the economy sending mixed signals, average mortgage interest rates—which have been hovering right above historic lows for weeks—may be a little confused on which way to go.

Weak GDP growth (1.2 percent in the advance Q2 estimate) contrasting with a strong jobs report for July (255,000 jobs added, nearly 3 percent wage growth, unemployment rate still under 5 percent) presents a mixed picture of the country’s economic health.

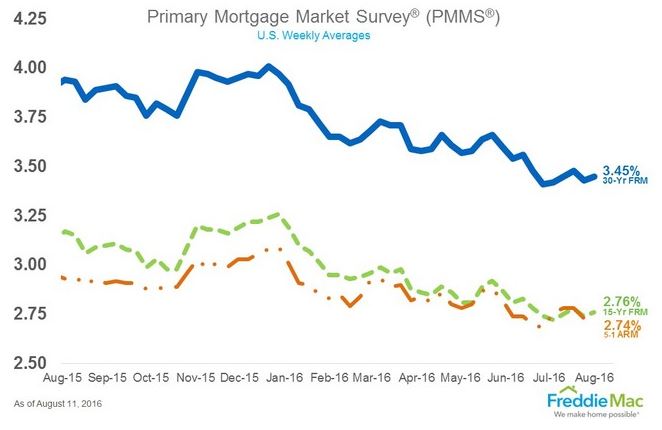

The result for mortgages is that the average 30-year FRM was little changed from the previous week for the week ending August 11. Depending on which analysis you look at this week, the average 30-year FRM either held steady or inched downward—but reports agree that the rate is near 3.5 percent. HSH.com reported the average 30-year FRM was unchanged over-the-week at 3.52 percent, while Freddie Mac reported in its Primary Mortgage Market Survey (PMMS) a dip of 2 basis points from 3.45 down to 3.43 percent.

The average 30-year FRM remained near its historic low of 3.31 percent set in late 2012. Last year at this time, the average rate was 3.94 percent.

“It's not clear how the economy is performing, so mortgage rates don't know which way to go at the moment," said Keith Gumbinger, vice president of HSH.com. “A weak report covering second quarter Gross Domestic Product growth two weeks ago gave way to a very solid July employment report. The drag of one report is being offset by the push of the other.”

The average 15-year FRM bumped up by 2 basis points from 2.74 percent to 2.76 percent but is down over-the-year from 3.17 percent, according to Freddie Mac.

Sean Becketti, chief economist with Freddie Mac, said of this week’s PMMS, “A surprisingly strong July jobs report showed 255,000 jobs added and 0.3 percent wage growth from last month, exceeding many experts' expectations. In response, the 10-Year Treasury yield rose to its highest level.”

Sean Becketti, chief economist with Freddie Mac, said of this week’s PMMS, “A surprisingly strong July jobs report showed 255,000 jobs added and 0.3 percent wage growth from last month, exceeding many experts' expectations. In response, the 10-Year Treasury yield rose to its highest level.”

The Fed could raise the federal funds target rate as soon as September if the economy is accelerating; according to HSH, futures markets after the July jobs report estimate the chances of a September rate hike by the Fed at 18 percent. Prior to the report, futures markets reported the likelihood of liftoff for the Fed in September at 12 percent. One more employment summary (the August jobs report) will come out before the next Federal Open Market Committee meeting on September 20 and 21; if the news for that report is good, combined with July’s solid report, it may be enough to convince the Fed to raise rates.

“More data covering July and fresh August reports will come in the next few weeks; if solid, they could push mortgage rates a little higher as we go. With that said, we will remain far closer to the year's lows than highs, so opportunities for cheap home financing will continue to persist for a good while yet,” Gumbinger said.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news