Independent monitor Thomas J. Perrelli has credited Citi with another $208.6 million in consumer relief toward its $2.5 billion obligation under the terms of a July 2014 settlement with the U.S. Department of Justice and five states for selling toxic residential mortgage-backed securities to investors before the financial crisis.

Independent monitor Thomas J. Perrelli has credited Citi with another $208.6 million in consumer relief toward its $2.5 billion obligation under the terms of a July 2014 settlement with the U.S. Department of Justice and five states for selling toxic residential mortgage-backed securities to investors before the financial crisis.

The amount credited to Citi in the most recent report brings the total of consumer relief provided by the bank up to $897.7 million, putting it approximately a third of the way toward its obligation. The bank has until 2018 to pay the $2.5 billion in consumer relief it agreed to in the settlement.

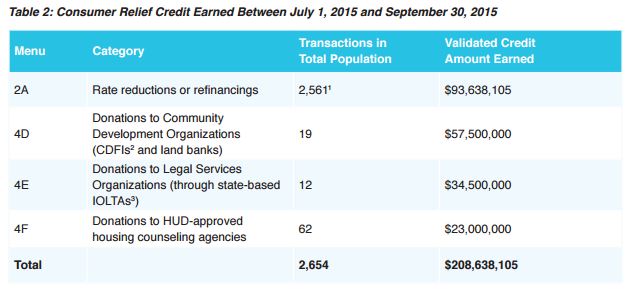

The $208.6 million was provided in four different categories covering the third quarter of 2015 (July 1 through September 30, 2015). The relief was provided in 2,654 transactions across four categories: Rate reductions or refinancings, donations to community development organizations, donations to legal services organizations, and donations to HUD-approved counseling agencies. The majority of the transactions (2,561 of them) were in the rate reductions or refinance category.

Prior to Monday’s report, Perrelli had credited Citi with $689.1 million in consumer relief covering 15,800 transactions.

A Citi spokesperson declined to comment on the monitor’s report.

Citigroup settled with the DOJ and five states (California, New York, Illinois, Massachusetts, and Delaware) for a total of $7 billion in July 2014 amid claims that the bank misled investors as to the quality of mortgage-backed securities it sold. The portion of the penalty that went to the DOJ was $4 billion, which was the largest civil penalty to date under the Financial Institutions Reform, Recovery and Enforcement Act (FIRREA). The report released Monday was Perrelli's fifth since the settlement was reached.

Click here to see Perrelli’s complete report released Thursday.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news