Home prices nationwide rose 1.3 percent in the third quarter due to historically low interest rates, tight inventories, confident buyers, and higher incomes.

Home prices nationwide rose 1.3 percent in the third quarter due to historically low interest rates, tight inventories, confident buyers, and higher incomes.

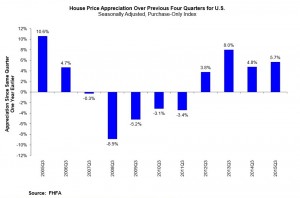

The Federal Housing Finance Agency (FHFA) House Price Index (HPI) showed that the 1.3 percent increase marks the 17th consecutive quarterly price increase in the purchase-only, seasonally adjusted index.

According to the report, the FHFA’s seasonally adjusted index for September rose 0.8 percent month-over-month. In addition, home prices are up 5.7 percent year-over-year.

“The long-anticipated slowdown in home price appreciation did not occur in the third quarter,” said Andrew Leventis, FHFA Principal Economist. “The factors that have contributed to extraordinary price growth over the last few years—low interest rates, tight inventories, strong buyer confidence, and improving income growth—continued to drive prices upward in much of the country. However, as prices continue to rise, reduced affordability will be a stronger market headwind."

Over the last year, inflation-adjusted home prices rose 7.1 percent, the data showed.

FHFA found that home prices increased in every state—except West Virginia—and in the District of Columbia in the third quarter year-over-year.

FHFA's Top Five Areas in Annual Appreciation:

- District of Columbia – 15.4 percent

- Colorado – 12.7 percent

- Nevada – 12.4 percent

- Oregon – 10.0 percent

- Florida – 10.0 percent

Within the 100 largest metros, four-quarter price increases were recorded in North Port-Sarasota-Bradenton, Florida, where prices rose by 16.1 percent. On the other hand, home prices came in at their lowest in El Paso, Texas, where they declined 3.6 percent.

The FHFA report showed that in the Mountain division, home price rose the most, with a 2.4 percent quarterly increase and a 9.0 percent year-over-year increase. In the New England division, home prices were weak, only rising 0.2 percent quarter-over-quarter.

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news