Employment gains, wage growth, and continued low mortgage rates are pushing home prices up both year-over-year and month-over-month.

Employment gains, wage growth, and continued low mortgage rates are pushing home prices up both year-over-year and month-over-month.

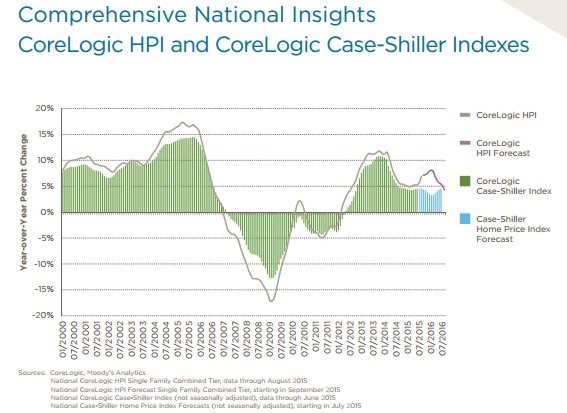

In August, home prices recorded a 6.9 percent year-over-year gain for the single-family combined tier, including distressed sales, CoreLogic's U.S. Home Price Insights Report found. This will mark the 42nd consecutive month of year-over-year increases. Meanwhile, on a month-over-month basis, home prices rose 1.2 percent.

National single-family home prices remain 6.3 percent below peak values recorded in April 2006, but prices are forecasted to reach a new peak level in April 2017.

CoreLogic forecasts that home prices in the single-family combined tier will remain flat in September and rise 4.3 percent from August 2015 to August 2016.

“Economic forecasts generally project higher mortgage rates and more single-family housing starts for 2016. These forces should dampen demand and augment supply, leading to a moderation in home price growth,” said Frank Nothaft, chief economist for CoreLogic.

According to the report, 12 states reached new highs in August including Alaska (2.2 percent), Colorado (10.4 percent), Hawaii (7.7 percent), Iowa (3.1 percent), Maine (3.1 percent), Montana (3.4 percent), Nebraska (5.5 percent), New York (8.6 percent), Oklahoma (3.6 percent), South Dakota (6.9 percent), Tennessee (5.9 percent), and Texas (7.3 percent).

According to the report, 12 states reached new highs in August including Alaska (2.2 percent), Colorado (10.4 percent), Hawaii (7.7 percent), Iowa (3.1 percent), Maine (3.1 percent), Montana (3.4 percent), Nebraska (5.5 percent), New York (8.6 percent), Oklahoma (3.6 percent), South Dakota (6.9 percent), Tennessee (5.9 percent), and Texas (7.3 percent).

Mississippi was the only state to post negative year-over-year home price appreciation at -0.88 percent.

Five states still remain far off peak values in August: Nevada (-29.9 percent), Florida (28.1 percent), Arizona (25.3 percent), Rhode Island (24.1 percent), and Maryland (19.4 percent).

“Home price appreciation in cities like New York, Los Angeles, Dallas, Atlanta, and San Francisco remain very strong reflecting higher demand and constrained supplies,” said Anand Nallathambi, president and CEO of CoreLogic.

He added, “Continued gains in employment, wage growth and historically low mortgage rates are bolstering home sales and home price gains. In addition, an increasing number of major metropolitan areas are experiencing ever-more severe shortfalls in affordable housing due to supply constraints and higher rental costs. These factors will likely support continued home price appreciation in 2016 and possibly beyond.”

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news