Nationwide, homebuilding has been weak for many months while home prices continue to appreciate. Despite the strong demand for affordable housing, builders generally are not building enough housing to keep up with the demand due to lagging permit numbers and rising labor and material costs.

Nationwide, homebuilding has been weak for many months while home prices continue to appreciate. Despite the strong demand for affordable housing, builders generally are not building enough housing to keep up with the demand due to lagging permit numbers and rising labor and material costs.

Some markets, such as those in the Southwest and Southeast, can build homes fast enough to keep up with rising demand while other markets—such as those in the Pacific West (San Francisco) and Northeast (Pittsburgh)—cannot.

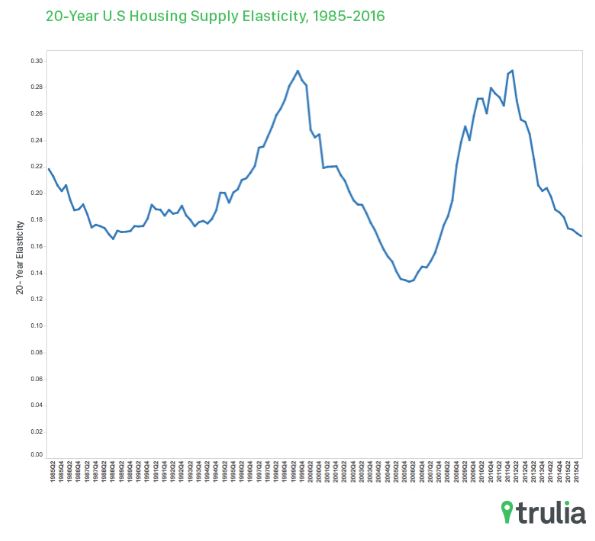

A recent study conducted by Trulia on what economists call “elasticity,” or in other words, how much new housing is built relative to demand, found that the rate at which housing supply has increased relative to demand is low. Elasticity has fluctuated in the past 30 years, but builders are not providing housing at the same rate as prices appreciate than they have in the past, according to Trulia.

The markets that are most elastic are able to build more housing relative to price appreciation, while those that are the least elastic are not able.

Keeping in mind that the higher the elasticity number, the more housing is built to meet demand in a given market, Trulia found that the current national long-run housing supply elasticity rate is 0.17 percent—which is 3 points below its 30-year average of 0.2 and just more than half of the peak elasticity of 0.29 from 1994. Also, long-run elasticity at the metro level can vary greatly; the metros of Las Vegas, Raleigh-Durham, and Albuquerque each have elasticity higher than 0.8, while elasticity is under 0.5 in markets like San Francisco, Los Angeles, and New Orleans.

Keeping in mind that the higher the elasticity number, the more housing is built to meet demand in a given market, Trulia found that the current national long-run housing supply elasticity rate is 0.17 percent—which is 3 points below its 30-year average of 0.2 and just more than half of the peak elasticity of 0.29 from 1994. Also, long-run elasticity at the metro level can vary greatly; the metros of Las Vegas, Raleigh-Durham, and Albuquerque each have elasticity higher than 0.8, while elasticity is under 0.5 in markets like San Francisco, Los Angeles, and New Orleans.

“Of late, land use regulation, and in particular, zoning, has been blamed for keeping supply low in many markets,” the report stated. “That story, however, is a simplistic one that overlooks the nuances involved with how local governments actually employ zoning across the country. Our research finds that local bureaucracy, measured by building approval delays, affect housing supply elasticity rather than restrictive zoning.”

Government regulation is not the only factor that can affect a market’s elasticity, according to Trulia. Natural restrictions can affect it as well—for example, in places with steep topography surrounded by water (San Francisco) it is more difficult to build new homes. By comparison, it is easier to build in metros with a flat buildable landscape, such as Phoenix. Also, it is easier to obtain building permits in areas that feature less regulation (New Orleans and Mobile, Alabama) than in areas with more regulation (Honolulu, Los Angeles).

Click here to view the complete Trulia report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news