A drop in first-time homeownership in the U.S., due to the lack of affordable housing, has given single-family rental (SFR) securitizations a credit positive boost.

A drop in first-time homeownership in the U.S., due to the lack of affordable housing, has given single-family rental (SFR) securitizations a credit positive boost.

Moody's Investors Service said in a report that housing affordability for first-time homebuyers has been decreasing since 2000. This phenomenon has, in turn, provided a higher demand for rentals in the market.

Moody's reported that the lack of affordability for first-time homeowners, due to a decrease in personal income and rising home prices, has hit the Generation Y cohort especially hard as those in their 20s and 30s seek to form households and purchase homes.

"A dearth of “for-sale” inventory of mid-to-lower price homes, combined with ongoing tight credit conditions, forces many to remain in rentals," Moody's said. "In addition, many potential first-time home buyers are burdened with high student loans that further constrain their buying capabilities. As a consequence, demand for rentals is remaining very strong for the limited number of available rental properties."

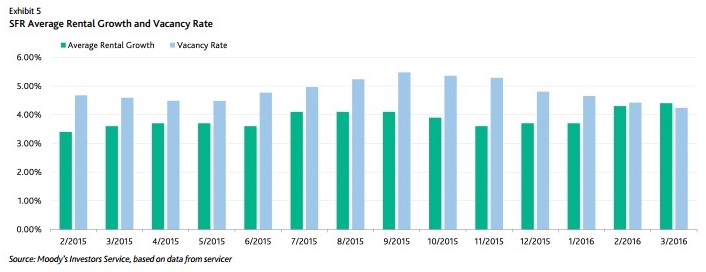

The U.S. Census Bureau reported that the rental vacancy is now at 7 percent, down from 11 percent in 2009.

The U.S. Census Bureau reported that the rental vacancy is now at 7 percent, down from 11 percent in 2009.

Moody's believes that the "drop in vacancy bodes well for the SFRs that we rate, especially regarding anticipated future enhanced rental revenue as Gen Y renters are a large component of SFR renters. This also portends higher liquidation proceeds on potential sales of SFR properties."

The report noted that rental rates will continue benefit SFR securitizations. Moody's said that the increasingly unattainable goal of homeownership for many and the low national rental vacancy rate will raise rental demand and rents, both of which bode well for SFR cash flows.

"Stronger demand for rental properties will benefit SFR securitizations by enhancing borrower and transaction-specific revenue streams and net cash flows, while also potentially increasing recoveries on foreclosures of underlying properties, should the need arise," the report said. "The continued financial strength of borrowers and compliance with transaction performance metrics are more likely in this healthy industry environment."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news