New, healthy housing markets are emerging in the midst of further improvement of the real estate market overall. Which markets present the most opportunity for investors?

New, healthy housing markets are emerging in the midst of further improvement of the real estate market overall. Which markets present the most opportunity for investors?

Nationwide's Health of Housing Markets Report for the first quarter of 2016 showed that its leading index of healthy housing markets (LIHHM) is in a healthy zone which suggests that the housing market is a sustainable condition.

According to the report, the current value for the national index is 105.4, the lowest level in two years, where a value over 100 suggests that the national housing market is healthy, with a low chance of a downturn.

Household formations, which had been above the long-term trend for the past year, fell sharply in the fourth quarter—lowering the main demographic housing demand factor in the national LIHHM," Nationwide said in the report, "Regionally, the LIHHM performance rankings show that the vast majority of metro areas across the country are healthy, indicating that few regional housing markets are vulnerable to a housing downturn—but the outlook for sustainable housing activity in local markets with strong ties to the energy sector continues to deteriorate as low oil prices persist."

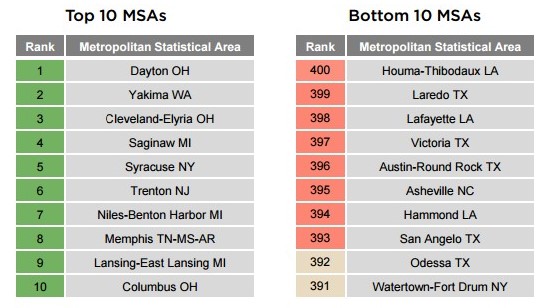

According to the data, the top 10 healthiest MSAs are located in Dayton, Ohio; Yakima, Washington; Cleveland-Elyria, Ohio; Saginaw, Michigan; and Syracuse. New York; Trenton. New Jersey; Niles-Benton Harbor, Michigan; Memphis, Tennessee-Mississippi-Arkansas; Lansing-East Lansing, Michigan; and Columbus, Ohio.

According to the data, the top 10 healthiest MSAs are located in Dayton, Ohio; Yakima, Washington; Cleveland-Elyria, Ohio; Saginaw, Michigan; and Syracuse. New York; Trenton. New Jersey; Niles-Benton Harbor, Michigan; Memphis, Tennessee-Mississippi-Arkansas; Lansing-East Lansing, Michigan; and Columbus, Ohio.

Nationwide also reported that demographics are expected to "turn positive again for housing demand soon, in spite of a surprising decline in household growth at the end of 2015."

"Trends in household growth are a key determinant of housing demand at the national and local levels. Household formations tend to accelerate as employment and income conditions improve, supporting further growth for both rental and owner-occupied units," the report stated. "The balance between housing supply and demand is an important driver of healthy trends in house price growth and housing affordability."

Nationwide found that data shows household growth will impact the overall housing market health in the following ways:

- Above-average growth in the housing boom: Following a drop-off in 2002-03 in response to the 2001 recession and accompanying the “jobless recovery,” average household growth was stronger than the long-term median of 1.2 million per year. Positive economic growth, strong job gains, and double-digit house price gains led to a surge in household formations during the housing boom—helping to create imbalances in the housing market.

- Bust recession and tepid recovery: Bust, recession, and tepid recovery: Weak household growth following the Great Recession (well Weak household growth following the Great Recession (well-below the long-term median) was indicative of still strained labor market conditions for many potential homebuyers, particularly those from the millennial generation.

- Recent growth and looking ahead: Beginning in the fourth quarter of 2014, the cumulative boost from stronger job growth over the prior two years, particularly for the 25-34 age cohort, and the pent-up demand to form households resulted in a sizable jump in national household formations. The recent economic, jobs and wage data do not support the surprising 2015 Q4 decline. Consequently, we expect LIHHM household formations to accelerate again soon, boosting housing demand and pushing up the LIHHM.

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news