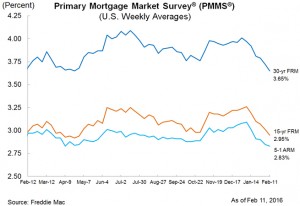

Mortgage interest rates have declined every week since the start of the year, and Freddie Mac believes this could continue until Treasury yields return to normal levels.

Freddie Mac ‘s Primary Mortgage Market Survey found that mortgage rates moved down for the sixth consecutive week amid “ongoing market volatility.”

For the week ending February 11, 2016, the average 30-year fixed rate mortgage (FRM) reached 3.65 percent with an average 0.5 point, down from last week when it averaged 3.72 percent. Last yea r, the 30-year rate was 3.69 percent. The 30-year rate is currently just slightly off the low of 3.59 percent recorded in 2015.

r, the 30-year rate was 3.69 percent. The 30-year rate is currently just slightly off the low of 3.59 percent recorded in 2015.

Sean Becketti, Chief Economist at Freddie Mac noted, "In a falling rate environment, mortgage rates often adjust more slowly than capital market rates, and the early-2016 flight-to-quality has run true to form. The 30-year mortgage rate has dropped 36 basis points since the start of the year, while the yield on the 10-year Treasury has dropped 59 basis points over the same period. If Treasury yields were to hold at current levels, mortgage rates might well sink a little further before stabilizing."

According to the survey, the 15-year FRM averaged 2.95 percent this week with an average 0.5 point. Last week, the 15-year rate was 3.01 percent down and year ago at this time, the 15-year FRM averaged 2.99 percent.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.83 percent with an average 0.4 point this week, the report showed. Last week, it was 2.85 percent and a year ago it averaged 2.97 percent.

As mortgage rates continue to climb, new home purchases also rose. The Mortgage Bankers Association (MBA) Builder Application Survey data for January 2016 shows mortgage applications for new home purchases increased by 14 percent month-over-month.

According to the survey, conventional loans composed 67.4 percent of loan applications, FHA loans composed 19.5 percent, RHS/USDA loans composed 0.7 percent, and VA loans composed 12.4 percent.

The data showed that the loan size declined from $333,182 in December 2015 to $325,806 in January 2016.

Single-family home sales are projected to run at a seasonally adjusted annual rate of 499,000 units in January 2016, up 4.0 percent from the December pace of 480,000 units, according to the MBA.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news