Although mortgage interest rates continue remain at historical lows, potential buyers are steering clear of the housing market.

Although mortgage interest rates continue remain at historical lows, potential buyers are steering clear of the housing market.

Freddie Mac reported last week that mortgage interest rates fell for the fourth consecutive week to 3.79 percent compared to the week before when the rate was 3.81 percent.

For the week ending January 29, 2016, mortgage applications decreased 2.6 percent from one week earlier, according to the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey.

Matthew Pointon, Property Economist at Capital Economics noted that the low interest rates "might seem counterintuitive given that the Fed hiked interest rates in December. But the flight to safety triggered by the turmoil in the oil and equity markets has pushed down Treasury yields and therefore mortgage rates."

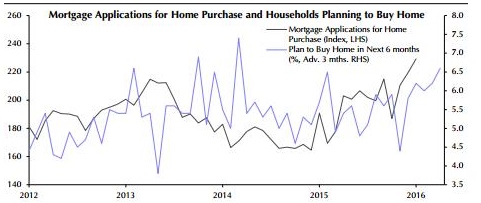

"And although we think rates will increase this year, a strong labour market and easing in lending standards will ensure applications for home purchase see further gains," he said.

Source: Capital Economics

According to the MBA, mortgage application volume increased 11 percent from last week on an unadjusted basis. The Refinance Index rose 0.3 percent to its highest level since October 2015. The seasonally adjusted Purchase Index decreased 7 percent, while the unadjusted Purchase Index increased 11 percent and was 17 percent higher than the same week one year ago.

The MBA reported that the refinance share of mortgage activity increased to 59.2 percent of total applications from 59.0 percent the previous week. Meanwhile, adjustable-rate mortgages (ARM) decreased to 5.9 percent of total applications.

The FHA share of total applications increased to 12.9 percent from 12.7 percent the week prior. The VA and USDA share of total applications both remained unchanged at 11.1 percent and 0.7 percent, respectively.

"Admittedly, a lack of homes for sale will act as a constraint on mortgage demand for some time yet," Pointon noted. "Even so, with earnings growth finally set to rise this year, we expect households will be able to cope with a gradual rise in interest rates. Mortgage applications for home purchase will therefore make further gains during 2016."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news