First-time homebuyers have been touch-and-go in the housing market since the crisis, but that here today, gone tomorrow trend could be changing for the better.

The American Enterprise Institute (AEI) International Center on Housing Risk found that the share and volume of first-time homebuyers increased year-over-year in December.

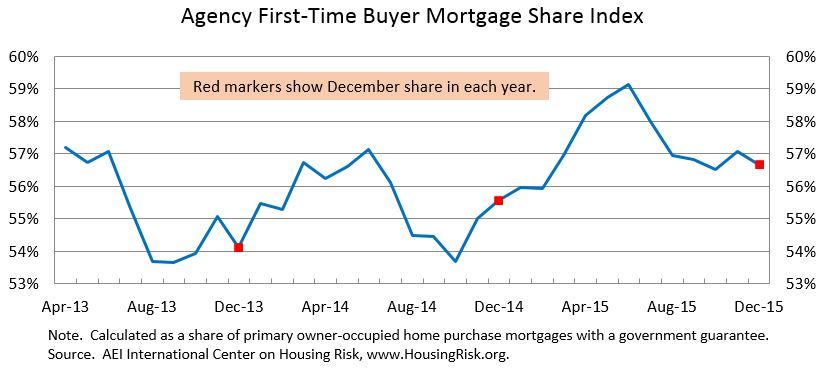

According to AEI's First-Time Buyer Mortgage Share Index (FBMSI) released Tuesday, first-time buyers accounted for 56.7 percent of primary owner-occupied home purchase mortgages with a government guarantee in December 2015. This number is 1 percent above the December 2014 share of 55.5 percent.

AEI credits "improvements in the labor market, riskier mortgage lending, and continuing low mortgage rates" for the spike in first-time buyers.

“On a year-over-year basis, first-time buyer demand increased in December, continuing the trend of the last 14 months," said Edward Pinto, Codirector of AEI’s International Center on Housing Risk. “Strong demand, in combination with shortness of supply, is driving home prices up faster than incomes and inflation.”

“On a year-over-year basis, first-time buyer demand increased in December, continuing the trend of the last 14 months," said Edward Pinto, Codirector of AEI’s International Center on Housing Risk. “Strong demand, in combination with shortness of supply, is driving home prices up faster than incomes and inflation.”

The share of first-time buyers within the Federal Housing Administration (FHA) was just over 80 percent, while Freddie Mac's share was approximately 40 percent, the data showed. Fannie Mae's share of first-time buyers has consistently been near 43.5 percent in December.

According to the report, the combined FBMSI totaled about 51.2 percent in December 2015, the same as the previous month and up from 50.2 percent a year earlier.

Purchase mortgages going to first-time buyers in December totaled an estimated 124,000, up 10 percent from the level in December 2014. The increase in first-time buyers loan count surpassed the 7 percent rise in total agency purchase loan volume over the same period. "Both growth rates may have been held down by the implementation of the TILA-RESPA Integrated Disclosure (TRID) rule,"AEI stated.

"The rising first-time buyer share and the strong increase in first-time buyer sales volume help explain the tight inventory conditions in the long-running seller’s market," the report said. "In November, the unsold inventory of existing single-family homes stood at 5.2 months of sales, while the unsold inventory of new single-family homes represented 5.7 months of sales; both are below the threshold for a tight market."

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news