In a surprising twist of events, mortgage rates are kicking off the New Year under 4 percent, even after the Federal Reserve's decision to raise rates in December.

In a surprising twist of events, mortgage rates are kicking off the New Year under 4 percent, even after the Federal Reserve's decision to raise rates in December.

So what gives? Why are rates so low?

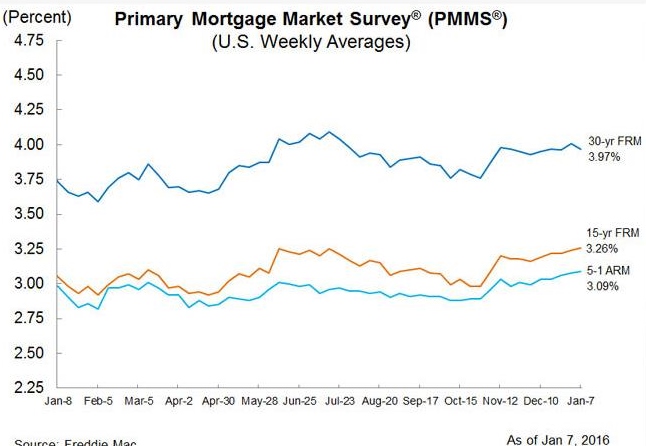

Freddie Mac today released the results of its Primary Mortgage Market Survey (PMMS), showing mortgage rates mixed with the 30-year fixed-rate falling back below 4 percent to start the year.

According to Freddie Mac, the 30-year fixed-rate mortgage (FRM) averaged 3.97 percent with an average 0.6 point for the week. Last week the 30-year fixed-rate mortgage was higher at 4.01 percent, and a year ago at this time, the 30-year FRM averaged 3.73 percent.

Sean Becketti, Chief Economist at Freddie Mac says that the reason for the decline in mortgage interest rates is a direct reflection of global economic concerns.

Sean Becketti, Chief Economist at Freddie Mac says that the reason for the decline in mortgage interest rates is a direct reflection of global economic concerns.

"Concerns about overseas economic developments have dominated financial markets to start the year. U.S. Treasury bond yields fell amidst a global equity selloff and flight to safety. In response, the 30-year mortgage rate dipped 4 basis points to 3.97 percent," Becketti explained.

Freddie Mac also found that the 15-year FRM averaged 3.26 percent this week with an average 0.5 point, slightly up from 3.24 percent last week. A year ago at this time, the 15-year FRM averaged 3.05 percent.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.09 percent this week with an average 0.5 point. Last week, it was even lower, averaging 3.08 percent, and a year ago, the 5-year ARM averaged 2.98 percent.

In December, the Federal Open Market Committee made the long-awaited, much-anticipated announcement on Wednesday afternoon that federal funds target rate will increase by a quarter of a percentage point from its near-zero level where it has been since 2006.

The federal funds rate is now one-fourth to one-half percent, according to the FOMC.

"This action marks the end of an extraordinary seven-year period during which the federal funds rate was held near zero to support the recovery of the economy from the worst financial crisis and recession since the Great Depression. It also recognizes the considerable progress that has been made toward restoring jobs, raising incomes, and easing the economic hardship of millions of Americans. And it reflects the Committee’s confidence that the economy will continue to strengthen. The economic recovery has clearly come a long way, although it is not yet complete," said Fed Chair Janet Yellen.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news