In a new study, Zillow asks the thought provoking question—what will housing markets look like in the future when sea levels start to rise? The study, titled “Climate Change and Home: Who would Lose the Most to a Rising Tide?” analyzed the types of homes, and demographic of homeowner impacted, based off of estimates of rising sea levels in the next 100 years.

In a new study, Zillow asks the thought provoking question—what will housing markets look like in the future when sea levels start to rise? The study, titled “Climate Change and Home: Who would Lose the Most to a Rising Tide?” analyzed the types of homes, and demographic of homeowner impacted, based off of estimates of rising sea levels in the next 100 years.

“We've seen the enormous impact flooding can have on a city and its residents," said Zillow Chief Economist Dr. Svenja Gudell. "It's harder for us to think about it on a long-term timeline, but the real risks that come with rising sea levels should not be ignored until it's too late to address them.”

According to Zillow, $916 billion worth of U.S. homes could be lost if sea levels rise six feet (which they are expected to by 2100). The properties impacted are forecasted to be in predominately less expensive locals, though 39 percent of homes will be among the most valuable.

“Living near the water is incredibly appealing for people around the country, but it also comes with additional considerations for buyers and homeowners. Homes in low-lying areas are also more susceptible to storm flooding and these risks could be realized on a much shorter timeline as we have seen time and time again," continued Gudell.

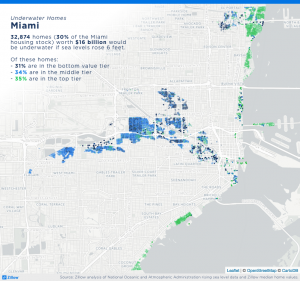

The 20 metropolitan areas that projected to be most heavily impacted are led (not surprisingly) by Miami, Florida. Tampa and Fort Myers also take the third and fourth spot respectively, with New York City and Boston also included in the top five. Five other Florida cities are included in list (Bradenton, Naples, Jacksonville, Key West, and Palm Cost). Cumulatively, the homes in Miami at risk are worth $217.3 billion.

The 20 metropolitan areas that projected to be most heavily impacted are led (not surprisingly) by Miami, Florida. Tampa and Fort Myers also take the third and fourth spot respectively, with New York City and Boston also included in the top five. Five other Florida cities are included in list (Bradenton, Naples, Jacksonville, Key West, and Palm Cost). Cumulatively, the homes in Miami at risk are worth $217.3 billion.

Houston, which is still dealing with the more pressing and time-sensitive damage caused by Hurricane Harvey, also appears on the list at No. 17.

While suburban homes are projected to most heavily impacted at 1,149,062 properties, there will be a projected 397,305 Urban Homes impacted and 210,462 rural homes impacted.

While, 2100 may seem too far out to worry about now, Gudell cautions that, “With organized and committed planning, cities can help protect both current and future residents.”

To view the full report, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news