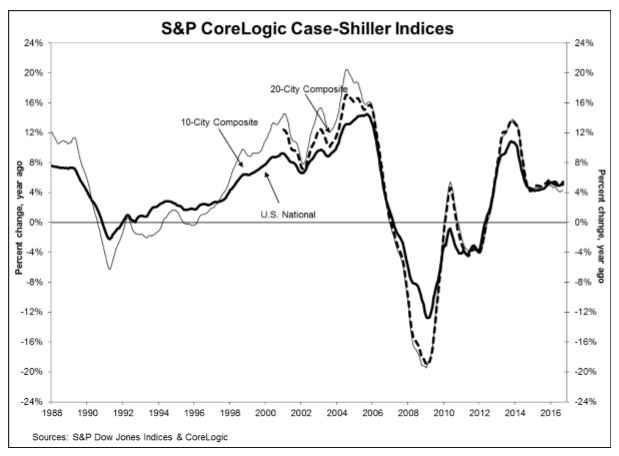

The September numbers from the S&P CoreLogic Case-Shiller Indices look impressive on the surface, surpassing peak 2006 numbers. But U.S. home prices remain still about 20 percent below that pre-recession peak, if you factor in inflation.

The September numbers from the S&P CoreLogic Case-Shiller Indices look impressive on the surface, surpassing peak 2006 numbers. But U.S. home prices remain still about 20 percent below that pre-recession peak, if you factor in inflation.

Ralph McLaughlin, chief economist at Trulia, in fact, said that “crossing this threshold is largely symbolic.”

Still, the numbers from September are up, and for the 53rd straight month. According to the index, home prices climbed 5.5 percent compared to a year ago, and 5.1 percent from August. Seattle and Portland led the way, each gaining 11 percent year-over-year. Twelve cities reported greater price increases in the year ending in September versus the year ending in August.

The new peak, said David Blitzer, managing director and chairman of the Index Committee at S&P Dow Jones, “will be seen as marking a shift from the housing recovery to the hoped-for start of a new advance.”

Miami, Tampa, Phoenix, and Las Vegas, which experienced the biggest booms, remain well below their all-time highs, Blitzer said.

“Other housing indicators are also giving positive signals,” he said. “Sales of existing and new homes are rising and housing starts at an annual rate of 1.3 million units are at a post-recession peak.”

For McLaughlin, the index numbers are more ambiguous.

“Home prices reaching their nominal pre-recession peaks brings mixed news for the housing market,” McLaughlin said. “It’s good news for homeowners who are no longer underwater, but not so great news for homebuyers who have seen prices outpace incomes for most of the housing market recovery.”

“Home prices reaching their nominal pre-recession peaks brings mixed news for the housing market,” McLaughlin said. “It’s good news for homeowners who are no longer underwater, but not so great news for homebuyers who have seen prices outpace incomes for most of the housing market recovery.”

McLaughlin called the housing recovery “uneven,” pointing out that markets that reached their pre-recession peaks are almost all in the South or West.

"And within those markets,” he said, “it’s mostly high-end homes that have surpassed the peak.”

According to the index, while most markets between Dallas and Seattle climbed 8 percent or higher since last year, markets between Cleveland and Boston climbed an average of about 4 percent. New York, though up since last year, showed the lowest annual price gains at just under 2 percent.

Click here to view the complete Case-Shiller Home Price Indices for September.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news