The United States housing market has experienced a spike in equity rich homeowners. According to the U.S. Home Equity and Underwater report curated by ATTOM Data Solutions, over 13 million homeowners have reached equity rich status in the third quarter of 2016, which is up by 2.6 million from Q3 2015. ATTOM defines equity rich as having an LTV ratio of 50 percent or lower.

The United States housing market has experienced a spike in equity rich homeowners. According to the U.S. Home Equity and Underwater report curated by ATTOM Data Solutions, over 13 million homeowners have reached equity rich status in the third quarter of 2016, which is up by 2.6 million from Q3 2015. ATTOM defines equity rich as having an LTV ratio of 50 percent or lower.

The increase in equity rich homeowners has a positive impact on the housing market by bringing fluidity back into the marketplace. Daren Blomquist, SVP at ATTOM Data Solutions, told MReport, “The declining number of homeowners in negative equity means the housing market is finally getting close to digging itself out of the deep hole resulting from the housing crash. More homeowners will regain enough equity to sell, helping to loosen up the inventory logjam that has been in place over the past couple of years.”

Blomquist expects the number of underwater homeowners to drop to 5 percent, which will be another step toward restoring balance between buyers and sellers and creating a healthier housing market.

The U.S. Home Equity and Underwater report stated that almost one in every five homeowners with a mortgage is equity rich. This is a result of an increase in homeownership tenures and rising home prices. The average homeownership tenure has increased to almost eight years.

“Median home prices increased on a year-over-year basis for the 18th consecutive quarter in Q3 2016, and homeowners who sold in the third quarter had owned their home an average of 7.94 years—a new high in our data and substantially higher than the average homeownership tenure of 4.26 years pre-recession,” Blomquist said. “As homeowners stay in their homes longer before moving up, they are amassing more equity wealth.”

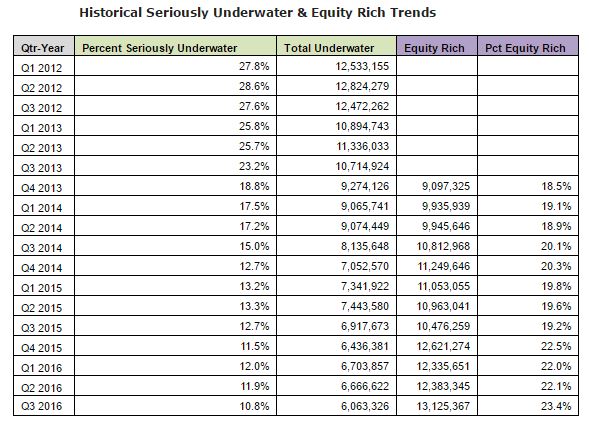

ATTOM’s numbers follow positive trends in the mortgage market. The number of homeowners who are seriously underwater has decreased by more than 800,000 since 2016. Approximately 6.7 million homeowners are seriously underwater, which represents 10.6 percent of U.S. homeowners with a mortgage—approximately half of the total of underwater homeowners at their peak in Q2 2012 (12.8 million). Over 20 percent of homes are underwater in cities like Las Vegas (25.0), Akron, Ohio (24.2) and Detroit (20.0).

Cities with the highest share of equity rich owners include San Jose (55.7 percent), San Francisco (49.8 percent) and Honolulu (39.3 percent). Other cities on the list are Los Angeles (38.2), Pittsburgh (34.5), Portland (33.1), San Diego (33.0), Oxnard-Thousand Oaks-Ventura, California (32.7), Seattle (31.5) and Austin (31.0).

To view the complete report, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news